In short, this metric shows how many days it takes to sell an item, get paid, and pay suppliers. In fact, as explained in the article about Amazon’s cash conversion cyclethanks also in part to how the company manages its accounts receivables, Amazon is a cash machine! The cash conversion cycle (CCC) is a metric that shows how long it takes for an organization to convert its resources into cash. I decided to cover Amazon as that is one of the most interesting case studies out there.

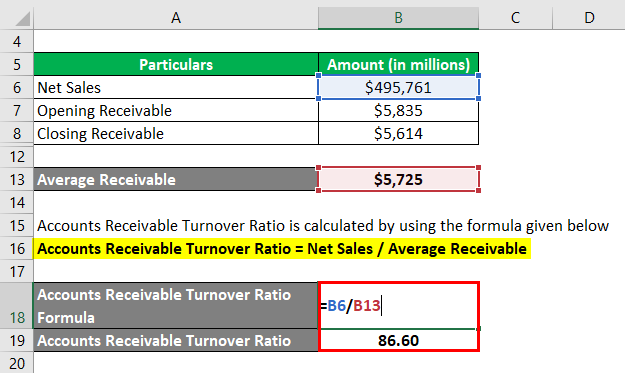

Let’s see how Amazon manages its accounts receivables! How Amazon is running on low accounts receivables Let’s dive now into a practical case study. Receivables Turnover in Days Ratio Formula = How do you assess the receivables turnover in days? Take 365 (number of days in a year ) and divide it by the receivables turnover ratio. What credit terms should a company have? In general no longer than 90 days. That’s because companies that allow too long credit terms for their customers can quickly fall into liquidity issues. However, it would be even more insightful to know how many days it takes for the company to collect those receivables. The receivables turnover ratio tells you how many times throughout the year the company is collecting its accounts receivable. If we take a small additional step, we can gain another critical insight. The higher the number, the more the company is working with a high level of cash as it is quickly turning its assets into cash for the business. What does that mean? It means that over the year (if computed on a yearly basis) the company collected its accounts receivables 10.52 times. When you start to be short of cash, the first place you might want to look into is the accounts receivable, to make sure you don’t have uncollected money from your customers. Thus, keeping an eye on the receivables turnover ratio can be similar to measuring your body temperature. That would lead to a liquidity crisis that in many cases leads to bankruptcy. Cash is critical for the short-term success of any organization.įor instance, take the case of a company that has a high turnover but no cash in the bank. That implies the company is not getting cash from the transaction. That means in the meanwhile the company will have on its balance sheet an accounts receivable item.

In fact, in many cases when purchasing a product or service companies allow customers to pay in 30 to 90 days (generally). The main aim of the receivables turnover ratio is to understand whether a company is efficiently collecting money from its customers. In a few cases, the number you see on the BS can be misleading. In conclusion, you understand that AR can be tricky. Therefore, you will decrease the AR by 70K and expense this amount as Bad Debt. Imagine you can collect 30% of the outstanding $100K. How would you know which percentage of the $100K can be collected? The truth is you won’t know until the company will be liquidated and assets sold. Its business though is in distress and in a few months may be bankrupt.

One of your main customers owes you $100K. Your customers are companies who have large operations, and for such reasons, they pay within 90 days of receiving the raw materials. Indeed, at times is very complicated to determine the number of receivables that can be collected.Įxample: Imagine you sell raw materials to companies that produce peanut butter. The AR can be one of the most challenging accounts on the BS when it comes to quantifying it. Therefore, if the customer did not pay yet for the service already rendered, the money owed will be shown under Accounts Receivable, with the heading of Current Assets. According to the matching principle, revenue is reported as soon as realizable. They include the amount of money to be received by customers. Digital Business Models Podcast by FourWeekMBA.Business Strategy Book Bundle By FourWeekMBA.An Entire MBA In Four Weeks By FourWeekMBA.100+ Business Models Book By FourWeekMBA.

0 kommentar(er)

0 kommentar(er)